Sure, but it really is sensible to wait as long as you'll be able to after getting your discharge. You will need to be careful and make particular which you’re acquiring a fantastic deal.

At the time your credit score has enhanced, you may be able to refinance your car bank loan and get a much better curiosity level in the future.

Any time you’re willing to buy, shop all around for the very best automobile mortgage supply. Assess rates and personal loan terms from diverse lenders to aid find the ideal offer on your economical condition.

Many of the leftover debt will be forgiven. Having a Chapter thirteen bankruptcy, the court will order you to Stay within a funds for as much as five decades, in which time most of the personal debt would be repayed. In either case, creditors will quit contacting and you can start finding your financial daily life back if you want.

Stage 3: Conserve a Deposit The more you set down on a whole new or used vehicle, the less You should finance. Preserving a larger down payment could help it become much easier to qualify in the event you don’t need to have a larger bank loan.

Though a bankruptcy could be terrible news for the credit score scores, acquiring accepted for a automobile financial loan remains to be attainable. But Before you begin making use of, you’ll want to wait right until after your bankruptcy is finalized.

The upper your score, the considerably less dangerous you surface to lenders. Bankruptcy is often really harmful to your credit score—it’s possible that your score may possibly fall 100 details or even more, according to exactly where it had been in advance of your filing.

On top of that, the Fair Credit score Reporting Act will allow credit bureaus to keep a bankruptcy with your credit report for approximately ten years in the day of discharge (not the day of filing of the situation). Any disputes that maybe you have having a credit company useful content should be solved by you and that company.

Credit rating.org is a non-income support having a 45-calendar year furthermore historical past of excellence and integrity. On top of that, their economical coaching for bankruptcy alternatives is on the market at Certainly no demand. It's crucial to navigate to this website understand how Credit score.

Nonetheless, some debts, like student loans and taxes, will remain. You can find stringent demands for who qualifies for this kind of bankruptcy. And it'll stay in your history for ten years, that may affect your capacity to get a home, obtain a car, or maybe obtain a position.

Rebuild your credit history for official site as long as feasible. This will enable you to take advantage of within your fresh new commence and make an application for an automobile Once your credit score is more powerful. The longer it is possible to hold out, the greater.

Nonetheless, some debts, like pupil discover this loans and taxes, will continue to be. You can find strict requirements for who qualifies for this kind of bankruptcy. And it will remain in your document for ten years, that may effect your power to get a house, obtain a vehicle, or go to these guys simply get yourself a work.

Entire Bio Katie Miller can be a shopper financial companies expert. She worked for nearly 20 years as an government, top multi-billion greenback home loan, credit card, and savings portfolios with operations throughout the world and a unique concentrate on The patron.

And - even when most of one's personal debt is erased via a bankruptcy filing, you'll frequently still owe 100% within your college student mortgage debt and taxes.

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Jenna Jameson Then & Now!

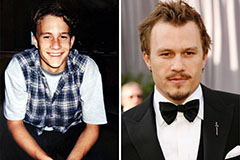

Jenna Jameson Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!